Sublime Text 2 is a text editor for OS X, Linux and Windows, currently in beta.

Snippets (sometimes) trigger within snippets

Snippets (sometimes) trigger within snippets

Note: when I ran through these steps again to reproduce it once more, it did NOT trigger within the snippet. However, subsequent tries DID reproduce the bug.

WIndows 7, ST2 Alpha 20110203

Quick find all should be restricted to selected region

Quick find all should be restricted to selected region

I love the:

1. Find

2. Hit alt-f3

3. hit escape

and then edit all occurrences feature of Sublimetext. However, if I selected a region of text and do this and restrict the search to that region of text then stage 1 above is fine but hitting alt-f3 then finds ALL occurrences in the file, not just the selected region. I propose that Alt-f3 (quick find all) should observe the "in selection" option and only find those items in that selected region.

can't save any file

can't save any file

I have a file open in ST2. I have no other programs running on the machine, which I just rebooted. I edit the file and hit Ctrl-S, I get the error 'can't save file'. Opening a random other file gets the same error on save. Editing the same files in any other program (notepad, Visual Studio) works fine as expected. Process Explorer tells me that this file is not open in any other program. I also found that a number of other people have run into this same dialog: http://www.sublimetext.com/forum/viewtopic.php?f=3&t=9240 with no known explanation.

I installed ST2 a few weeks ago and it worked up until a few days ago, and has not saved any files since then. I have rebooted the machine and closed every other program there is. The machine is running Windows Server 2012.

Multifile Edit - Split Screen

Multifile Edit - Split Screen

How to save/restore all the Sublime Text 2 config/plugins on another computer

How to save/restore all the Sublime Text 2 config/plugins on another computer

Fixes to java syntax

Fixes to java syntax

The following additions to the Java.tmLanguage file would be very wonderful.

Add to `repository -> parameters -> patterns`:

<dict>

<key>include</key>

<string>#annotations</string>

</dict>

Add to `repository -> parameters -> enums -> patterns`:

<dict>

<key>include</key>

<string>#comments</string>

</dict>

MultiMarkdown mode not recognizing 'format: complete' on first line (should be case insensitive for keys)

MultiMarkdown mode not recognizing 'format: complete' on first line (should be case insensitive for keys)

Metadata keys are case insensitive and stripped of all spaces during processing. This means that Base Header Level, base headerlevel, and baseheaderlevel are all the same.

However, in MultiMarkdown.tmLanguage, the check for "Format: complete" on the first line is case sensitive:

<key>firstLineMatch</key>

<string>^Format:\s*(?i:complete)\s*$</string>

Changing it to the following fixes the problem:

<key>firstLineMatch</key>

<string>^(?i:Format):\s*(?i:complete)\s*$</string>

problems with C syntax

problems with C syntax

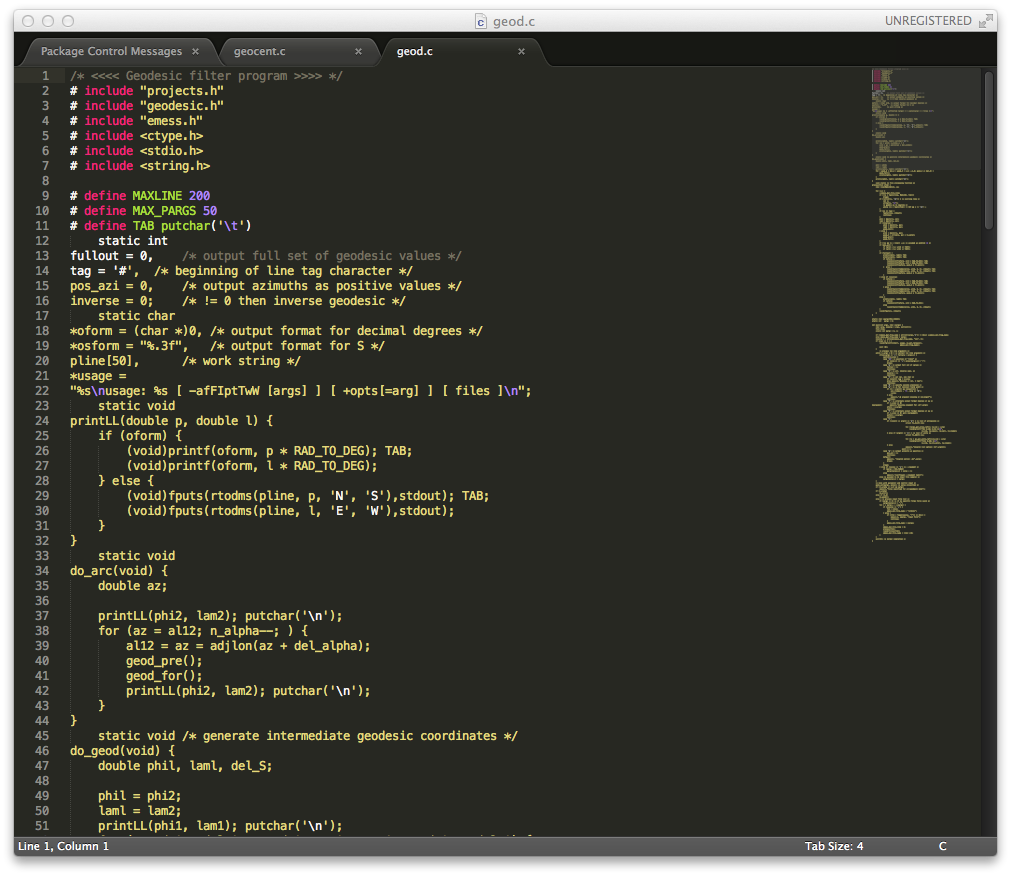

I was looking to use sublime text 2 in order to help me sort through some c code. This one file messes up the sublime c syntax coloring. Proj4 is a fairly popular projection library used for mapping and GIS. I think sublime is ready to rock some preprocessor statements and is confused by the crazy pound defines in this code. I hate looking at code from this library and would much rather look at sublimes gorgeous colors, but for now I'm stuck with Proj4:

http://svn.osgeo.org/metacrs/proj/trunk/proj/src/geod.c

Here's a screenshot:

Add the ability to enter a license key via bash or some other development environment automation tool such as boxen

Add the ability to enter a license key via bash or some other development environment automation tool such as boxen

"Where" box of the Find in Files dialog should have a pull-down

"Where" box of the Find in Files dialog should have a pull-down

I did not realize until just now that you could use the arrow keys in the Find in Files dialog's "where" field. This is great, but not obvious at all.

Apart from being more obvious to the user, the drop-down has the additional advantage of being able to see all the options, rather than having to tap tap tap tap on the arrow keys, where you have find trade off speed vs the possibility of skipping over what you are looking for.

Сервис поддержки клиентов работает на платформе UserEcho