Sublime Text 2 is a text editor for OS X, Linux and Windows, currently in beta.

Wrapped lines behaving odd with Ctrl+Cursor Keys

Wrapped lines behaving odd with Ctrl+Cursor Keys

Can we make Ctrl+Cursor keys or other operations treet wrapped text like every other editor does. Currently its possible to use Ctrl+Down and have a cursor placed where it thinks theres a new line when its just a continuation from the previous.

Im not sure if this is the desired functionality or not but I find it annoying from times when multi line editing many lines of text.

Great editor thanks :)

Pressing = in visual mode doesn't exit the visual mode with Vintage

Pressing = in visual mode doesn't exit the visual mode with Vintage

Bug in snippets with conditional insert with numbers

Bug in snippets with conditional insert with numbers

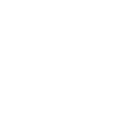

If you have a conditional insert in a mirrored field in a snippet and it's value is starting with a number, it's not inserted. Here is an example:

view.run_command("insert_snippet", {"contents" : "snippet: ${1:}${1/(.+)?/(?1:123)/}"})

I found a workaround to fix it: just adding parens — “()” — before the number fixes it (however, I'm not sure that plain braces shouldn't be inserted, so I'd recommend using the empty conditional insert there)

Clone File pushes minimap to the left

Clone File pushes minimap to the left

Better graphical design

Better graphical design

Should have regular expression while searching for a file using Ctrl+P

Should have regular expression while searching for a file using Ctrl+P

When we press Ctrl+P, we can search and open the file by either giving partial or full name of the file. But I would like to open ABC*.properties file [Note: * have any characters after ABC] which seems to be not possible.

Westhill Consulting Jakarta: What You Need to Know About IPO Investments

Westhill Consulting Jakarta: What You Need to Know About IPO Investments

Westhill Consulting is a market leader in the Financial Services category. Here is a guide to Initial Public Offerings (IPO's) intended to simplify the jargon and remove the fear that IPO's involve higher risk as compared to usual investments.

Westhill Consulting is a reputable investment advisory firm based in Jakarta Indonesia, dedicated to providing you the most advantageous investments based on how you want your portfolio managed for the private middle market.

You might be wondering how you can increase the profits you make from your market investing strategies. If you're searching for the most profitable forms of investing that are available today, you should definitely investigate the possibilities of using Initial Public Offering (IPO) investments.

A simple description of an IPO includes the fact that you're buying a business that is just entering the open marketplace. The moment the IPO is released to the public is the first time anyone has the ability to buy the company openly, and this will surely give you a good idea on where the stock itself resides when it comes to the value of the offering. You can wage it is preparing for a large rise in its value because they are just releasing their stock to the public.

Though most of the Initial Public Offering stocks skyrocket after they are first released, you must keep in mind that they are hardly a definite investment. Because of this, there are several factors you must definitely examine before you place your capital into this type of investment.

One of the first factors you must take into consideration before investing into the stock you are interested in is the basic fact that once the stock is available on the market you can't guess if there will be a great deal demand or a total lack.

Because of this, you must do your best to ascertain every bit of information available about the company before making a purchase.

As you comb the market for the best IPOs available today, you must consider the fact that IPOs are usually offered only to the market when a company plans on expansion. There are other instances where companies only want to increase their ability to borrow capital, but IPOs are mostly released to increase the amount of funds they have available for expansion plans.

It may look like a company which is preparing to expand is a sure bet on the stock market. However, that is not really the case. IPO stocks are usually considered as high-risk investments. That is why if you want to secure your investments to a degree, you must explore the overall performance of the company's operations in the long run.

When you have analyzed the essentials of the company you are interested on, you must also try to guess where the capital generated from the IPO will be used by the company. If you think the company's only choice is to put their capital into expansion activities, you can be sure that the stock value will increase over time because of the expanding capabilities of the business operation. As you examine the essentials of the company and estimate where the capital will be going once the IPO is sold to the public, you can make a reasonable evaluation of how the stocks are going to fare in the future. Being one of the top advisory firms in the industry, we gain the confidence of our clients by acting with integrity on all our business decisions.

Westhill Consulting practices a specific valuation procedure to determine how much a profitable business is worth and determine possible market opportunities.

http://www.westhillconsulting.com

Сервис поддержки клиентов работает на платформе UserEcho