Sublime Text 2 is a text editor for OS X, Linux and Windows, currently in beta.

Tyre&Auto Southbourne Group Review: Hur man passera ett MOT-test

Tyre&Auto Southbourne Group Review: Hur man passera ett MOT-test

Det är viktigt att se till att din bil är passar för att köra och är vägen lagligt, det är därför det måste genomgå en rutinmässig hälsokontroll varje år. Tyre&Auto Southbourne Group Review föreslår att du bör veta hur man gör en ordentlig kontroll på ditt fordon för att förhindra att misslyckas MOT testet.

Du bör kontrollera lamporna först. Se om alla lampor fungerar korrekt och om de är alla lika ljusa och tryck på bromsen pad att kontrollera om de bakre bromsljus lyser garageporten och om den gör det, det fungerar alldeles utmärkt. Snärta dimman lätta på och utanför efteråt för att kontrollera om den också fungerar korrekt.

Nästa är att du måste kontrollera däcken. Om mönsterdjupet understiger 2mm, föreslår Tyre&Auto Southbourne Group Review att du byter ut däcken innan du tar testet. Du får fortfarande en rådgivande not från mekanikern berätta att ersätta dessa däck så snart som möjligt även om bilen gått MOT testet. Däcktrycket bör också på den rekommenderade nivån.

MOT testet innebär också att undersöka din bil säkerhetsnivå. Göra några enkla lösningar på ditt fordon före provet eftersom mekanikern kommer också att testa drivrutin sida Visa säkerhet. Ta hand om vindrutetorkarna, backspegel, och vingen speglar i förväg, så att ditt fordon kommer att vara i mycket bra skick, vilket gör det laddade upp inför testet.

Du bör också rengöra ditt fordon inifrån och ut innan det tar testet eftersom några mekanik inte gillar service smutsiga bilar. Du kan undvika inför stora problem under MOT testet om du genomföra korrekt underhåll på din bil på en regelbunden basis.

Tyre&Auto Southbourne Group Review vill att du ska kontrollera vätskenivåerna, testa el och hålla däcken i god form så ofta som möjligt. Företaget kan också utföra en MOT test i ditt fordon, vilket inkluderar undersökning av både säkerheten för din bil och nivån på utsläpp i avgaserna.

Företaget erbjuder också en gratis, årlig påminnelse för dig och ditt fordon. och dess centra är alla ackrediterade av VOSA eller fordonet och föraren Services Agency, och varje medlem av personalen var välutbildad, så det är inga problem med dem göra sitt jobb ordentligt.

Post Post Crisis Era to Continue

Post Post Crisis Era to Continue

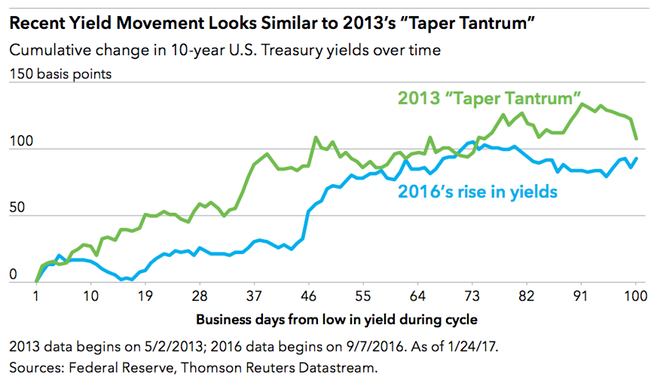

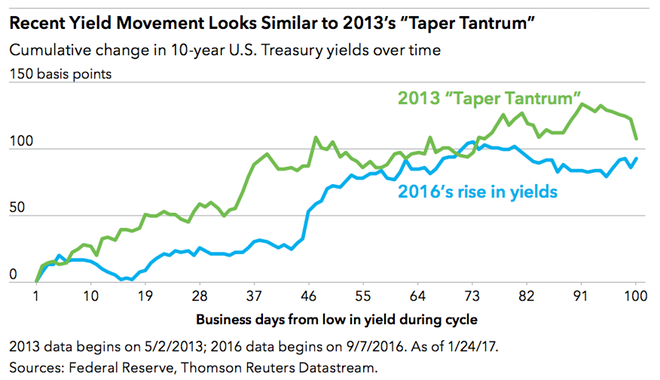

We’ve talked about the post-post-crisis era as one that is neither risk-off (a period like the financial crisis, when investors shun riskier assets) nor risk-on (a period like the post-crisis period, which we define from March 2009 through November 2014, when investors embrace riskier assets). In a post-post-crisis landscape, markets have a mixed outlook, in which growth is uneven and interest rates remain low.

Post Post Crisis Era to Continue

Post Post Crisis Era to Continue

We’ve talked about the post-post-crisis era as one that is neither risk-off (a period like the financial crisis, when investors shun riskier assets) nor risk-on (a period like the post-crisis period, which we define from March 2009 through November 2014, when investors embrace riskier assets). In a post-post-crisis landscape, markets have a mixed outlook, in which growth is uneven and interest rates remain low.

Five Keys to Investing in 2017

Five Keys to Investing in 2017

#1: Uncertainty Is a Sure Thing. Keep Calm and Carry On.

There are nearly 50 million people over 65 in the United States, and many of them have one thing in common: They want their dividends. Millions of retiring baby boomers need income, but they may have to search far and wide for yield.

Don’t get too high or too low. Try to maintain an even keel. Fight fear with facts.

Online Info Blog: Avoid scams

Online Info Blog: Avoid scams

The web can be a great place, but not everyone online has good intentions. Here are three simple ways to avoid scammers and stay safe on the web:

Online Info Blog: BBB warns about Valentine’s Day scams

Online Info Blog: BBB warns about Valentine’s Day scams

Flower Fails

Online Info Blog: BBB warns about Valentine’s Day scams

Online Info Blog: BBB warns about Valentine’s Day scams

Awareness and education are the best line of defense against fraud, and consumers can protect themselves by applying common sense and not letting emotion get in the way. Anyone can fall victim. Fraudsters even coach potential victims to ignore warnings such as this.

Software update popup on Ubuntu -- open Software Center directly

Software update popup on Ubuntu -- open Software Center directly

Update available popup on Ubuntu -- clicking Download opens your website, where I click to download a file, which opens the Software Center. This is a pain. Instead, just open the Software Center directly.

Sublime iOS - Why isn't it here by now!

Sublime iOS - Why isn't it here by now!

Simple one - Why is there not any hint of an iOS version of Sublime Text? Surely in terms of power and iOS SDK capability we could have it working as is on iOS?

An iPhone app would be stupid - but an iPad app with some mobile specific features like Dropbox/Drive support etc would be so awesome

Git push on clicking Save

Git push on clicking Save

I have a git repo on my mac. Whenever I want to test code, i do a git push to my linux dev vm running in the cloud. I'd like sublimetext to automatically do a git push whenever i click save. is there a macro that i can write to do this?

Customer support service by UserEcho