Sublime Text 2 is a text editor for OS X, Linux and Windows, currently in beta.

Massaging for Health, a Shearin Health Group Approach – PitchEngine

Massaging for Health, a Shearin Health Group Approach – PitchEngine

But what power does massage have that it provides so much healing benefits to humans? Even animals practice it instinctively as a means to heal themselves, as dogs and cats apparently do. Of course, we know that muscles need massaging in order to remove obstacles in our veins and to enhance blood circulation and breathing. It also removes unwanted dry skin and toxins within our bodies that other cleansing therapies may not totally remove. All in all, massage offers health benefits which are both physiological and emotional.

View source link here..

The emotional side of massage therapy derives from its social dimension as a form of therapy, as we have mentioned. Having someone take care or treat your body in a way that you or someone else you know intimately cannot do for you crosses a barrier that revolves around trust and harmony. One cannot entrust one’s body to someone who does not have the ability or intention to provide healing. In many cases, massage and prayer (or meditation -- notice the spa music they use?) go together. The event becomes essentially a social or cultural activity which goes beyond attaining healing to that of providing peace and harmony among people.

Massage as a therapy then does not deal only with healing the body but more so the mind. Spas have provided a very valuable service to modern society by providing a convenient escape where tired, harried and lonely people can totally relax and obtain body and mental rejuvenation. No wonder that it has become such a lucrative business for many people.

Health, obviously, is wealth in many practical ways.

Make powerful choices to create your maximum level of health with my facilitation skills and the wisdom and support of a group. Visit Jennifer Shearin Group Wellness Coaching.

Related Video:

Massaging for Health, a Shearin Health Group Approach

Jennifer Shearin Group Wellness Coaching – Road to Wellness Less Travelled

Coaching for Health and Life, Integrated Group Jennifer Shearin

Need an elegant antidote to global warming? Look to B.C.

Need an elegant antidote to global warming? Look to B.C.

Need an elegant antidote to global warming? Look to B.C.

The report from the Intergovernmental Panel on Climate Change (IPCC), released in Stockholm Friday, leaves almost no doubt that human activity can take the blame for the warming trend, even if the warming rate seems to be slowing. The conclusion came as no surprise. The 1996 IPCC report stated that the “balance of evidence suggests that there is a discernible human influence on global climate,” and the updates since then have reinforced that stance.

Once environment ministers and big industries digest the report, don’t expect a lot to change – even though the 1983-to-2012 period in the Northern Hemisphere was very likely the warmest 30-year period in 800 years, and the frequency and costliness of natural disasters (storms, floods, drought, fire, extreme temperatures) has been rising since the early 1980s. Reinsurance giant Munich Re reports that the damages from the 10 biggest natural catastrophes of 2012 alone, topped by the Hurricane Sandy storm surge, totalled more than $130-billion (U.S.).

The pity is that there is an efficient, fair way to reduce carbon footprints without throwing economies into reverse. It is one that is not impossibly complicated and prone to abuse like carbon-credit trading, or based on command-and-control regulations, such as milking taxpayers to subsidize renewable energy. It is carbon taxes. They are quietly being introduced by governments in North America, Europe and Asia, although not quickly enough. Given their relative simplicity and effectiveness, they ought to be ubiquitous.

More than a few prominent scientists and economists, among them Paul Ekins, director of the Institute for Sustainable Resources at University College of London, and Stewart Elgie of the University of Ottawa, think British Columbia’s carbon tax is a fine model. “The design of that carbon tax was the best in the world,” Mr. Ekins said in an interview.

The B.C. carbon tax applies to all fuels, from gasoline to propane, at the point of sale. It was launched in July, 2008 as the main effort in the province’s campaign to drop emissions by one-third by 2020. The tax was designed to be “revenue neutral” – that is, all the income it raised would be offset by reduced taxes elsewhere – and it was introduced gradually. By 2012, the tax per litre of gasoline was seven cents.

A study led by Mr. Elgie found that in the first four years of the carbon tax, B.C. fuel consumption fell 17.4 per cent per capita, and 18.8 per cent compared with the rest of Canada. In the first three years, the province’s greenhouse gas emissions fell 11 per cent (more recent data are not available). If all this were not good enough, B.C.’s economy did not get clobbered, either. Since the tax was introduced, its gross domestic product has kept pace with the rest of Canada.

The tax does not take an army of bureaucrats to administer and was relatively cheap to introduce. It went from concept to reality in a mere five months.

B.C.’s little tax beauty is not perfect. It does not apply to all carbon emissions, notably the flaring of natural gas by the drillers. It is being frozen at the current level, taking away some of its future punch.

Quebec and Alberta have less useful variants of the B.C. tax. (Alberta’s, born in 2007, was the first of its kind on the continent.) The other provinces lack such a tax and none exists at the federal level, where any new tax is treated with fear and loathing. Ditto in the United States, where the mere utterance of “tax” is considered political suicide, at least at the federal level.

Too bad, because carbon trading and regulations lack simplicity, cost fortunes to administer and are less fair and effective. A carbon tax merely sets the price of carbon use, allowing businesses and consumers to change their fuel-consumption behaviour at the lowest cost. Some will use public transportation more often; others will buy more fuel-efficient cars. Companies will innovate, knowing that fuel efficiency will save operating costs.

France, Italy, China and South Africa have recently introduced, or announced they will introduce, carbon taxes of one form or another. Several other European countries have them. All work to some degree, although they tend to lack ambition and get lost in the clutter of other climate-change mitigation efforts, from clean-technology subsidies to appliance performance standards.

The IPCC report will receive a barrage of criticism from the climate-change skeptics. They will dismiss the report as a fraud or a hoax because of the declining rate of warming; never mind that the planet is warming. They will ignore the data that reveal an alarming increase in natural catastrophes, such as floods. They will condemn carbon taxes as yet another tax grab, even if they are revenue neutral. B.C.’s fine example of a tax that helps the planet, yet neither hurts taxpayers nor growth, will fail to sway them.

Related Stories

https://foursquare.com/frostfrankie

Westhill Healthcare Consulting | Massachusetts - N.J. Commissioner Offers Insurance Purchasing Tips for Small Businesses

Westhill Healthcare Consulting | Massachusetts - N.J. Commissioner Offers Insurance Purchasing Tips for Small Businesses

Making the right insurance choices can have significant impact on the small business owner’s operation costs. With that in mind, New Jersey Department of Banking and Insurance Commissioner Ken Kobylowski offered some basic tips for small businesses for purchasing or updating their insurance coverage.

There are different types of policies available to small business owners that range from life insurance options to mandatory workers’ compensation.

Commissioner Kobylowski said small business and home-based business owners potentially have several different policies that can provide necessary protections.

“Small businesses should annually review their insurance policies to verify that their coverage meets their needs,” Commissioner Kobylowski said. “This could include workers’ compensation, commercial auto, business property and liability, group health and disability as well as group life and key-person life insurance.”

Commissioner Kobylowski offered the following tips:

What steps should a small business owner take?

• Shop around – Examine rates from several companies, being sure to compare plans providing identical coverage.

• Protect yourself – Stop. Call. Confirm. Verify with the Department that the companies quoting coverage are licensed by the State of New Jersey by calling 1-800-446-7467 or by checking online at www.dobi.nj.gov. Then use the National Association of Insurance Commissioners’ Consumer Information Resource (CIS) at https://eapps.naic.org/cis/ to compare a company offering coverage to other firms in the industry using their consumer complaint ratios.

• Review Annually – Small business insurance needs change as a company grows. Additional machinery purchased for a manufacturing plant or expansion to a larger facility could require an increase in property limits. Additions to an auto fleet could mean changes in a commercial auto policy or sales growth could result in the need for more business continuation coverage.

Commissioner Kobylowski reviewed the following policy options a small business owner might want to consider:

1. Workers’ Compensation. State law requires that all New Jersey employers, not covered by federal programs, have workers’ compensation coverage or be approved for self-insurance.

Typically, workers’ compensation covers the employee’s medical expenses, rehabilitation costs and lost wages if he or she is injured on the job. If an employer does not have workers’ compensation and an employee is injured on the job, the business may be liable for any medical expenses that individual incurs. The company might also face fines and penalties for noncompliance.

2. Property. Property insurance protects small business owners from losses due to damage to physical space or equipment and as a result of theft. For insurance purposes, a business’ property includes the physical building in which it resides, as well as its other assets.

All of the following, owned or leased, can be considered business property: the actual building; inventory; furniture, equipment and supplies; machinery; computers and other data processing equipment; valuable papers, books and documents; artwork and antiques; television sets, VCRs, DVD players, and satellite dishes; signs, fences and outdoor property not attached to a building; and non-tangible items, such as trademarks and copyrights.

3. Flood Insurance. Flood is not a covered peril in a standard business property insurance policy. Business owners can purchase flood coverage from the National Flood Insurance Program (NFIP), administered by FEMA. Flood insurance policies have a 30 day waiting period before going into effect. To find out more about the NFIP consumers can go to www.floodsmart.gov. If the flood insurance property limits from the NFIP are inadequate to cover a business, owners can check with an insurance agent or carrier representative about additional coverage options.

4. Ordinance or Law Coverage. This pays for rebuilding a destroyed property so that it will meet the current building codes. Older structures damaged may need upgraded electrical, heating, air conditioning and plumbing units based on current municipal codes. This covers the additional cost to upgrade due to new codes.

5. Business Interruption/Continuation. This type of insurance covers lost earnings due to a loss covered by one of the property insurance plans purchased, such as a fire or theft that shuts down a business for an extended period of time. Business interruption/continuation insurance covers expenses associated with running a business, such as payroll and utility bills, based on the company’s financial records.

Business interruption/continuation coverage can be added to a property insurance policy or purchased as part of a package insurance product.

6. Liability. This insurance product covers workplace risk, for example, if an individual falls while visiting a business premises, or a customer is hurt by a product a business sells, the business owner can be held responsible. Standard policies do not provide protection against sexual harassment, professional liability or commercial auto or truck claims.

7. Commercial auto. All motorized vehicles, whether used for personal or business purposes, need auto insurance. Automobile liability insurance – required by most states – covers medical expenses for injured persons and damages to the property of other individuals as a result of a motor vehicle accident caused by the insured’s negligence.

While the types of coverage provided by personal and commercial auto insurance policies are essentially the same, there are important distinctions. Typically, commercial auto insurance policies have higher liability limits, for example $1 million. They also may have provisions that cover rented and other non-owned vehicles, including employees’ cars driven for company business.

Several factors related to ownership and use of vehicles determine whether a personal or commercial policy is appropriate. These include: who owns or leases the vehicle –individually or the business as an entity; who drives the vehicle – owner or employees; and how the vehicle is principally used – for example, transporting people, delivering packages or carrying hazardous materials.

8. Umbrella Insurance. This coverage provides protection for an individual or business above the limits for a primary policy. It is recommended for a business with a value above its primary limits for various policies selected. It is also a smart purchase for high net worth individuals. A policy can cost relatively little for the protection it provides.

“Small business owners should discuss these insurance matters with a licensed insurance professional at an agency or carrier,” said Commissioner Kobylowski. “A life and health insurance professional should also be consulted to make sure every aspect of a small business is protected.”

Source: New Jersey Department of Banking and Insurance

http://www.linkedin.com/groups/Westhill-Consulting...

Value Creation of The Carlyle Group

Value Creation of The Carlyle Group

The Carlyle Group: Creating Value

The Carlyle Group: Creating Value

Value creation is at the core of our existence. We invest in assets, work to make them better and seek to sell them for a profit. Carlyle uses its One Carlyle global network, deep industry knowledge, Executive Operations Group and portfolio intelligence to create and execute a customized value creation plan for each of our corporate private equity and real asset investments. Our success helps investors achieve their goals, such as state pension funds working to secure the retirements of millions of public employees.

Customize window.show_input_panel() ?

Customize window.show_input_panel() ?

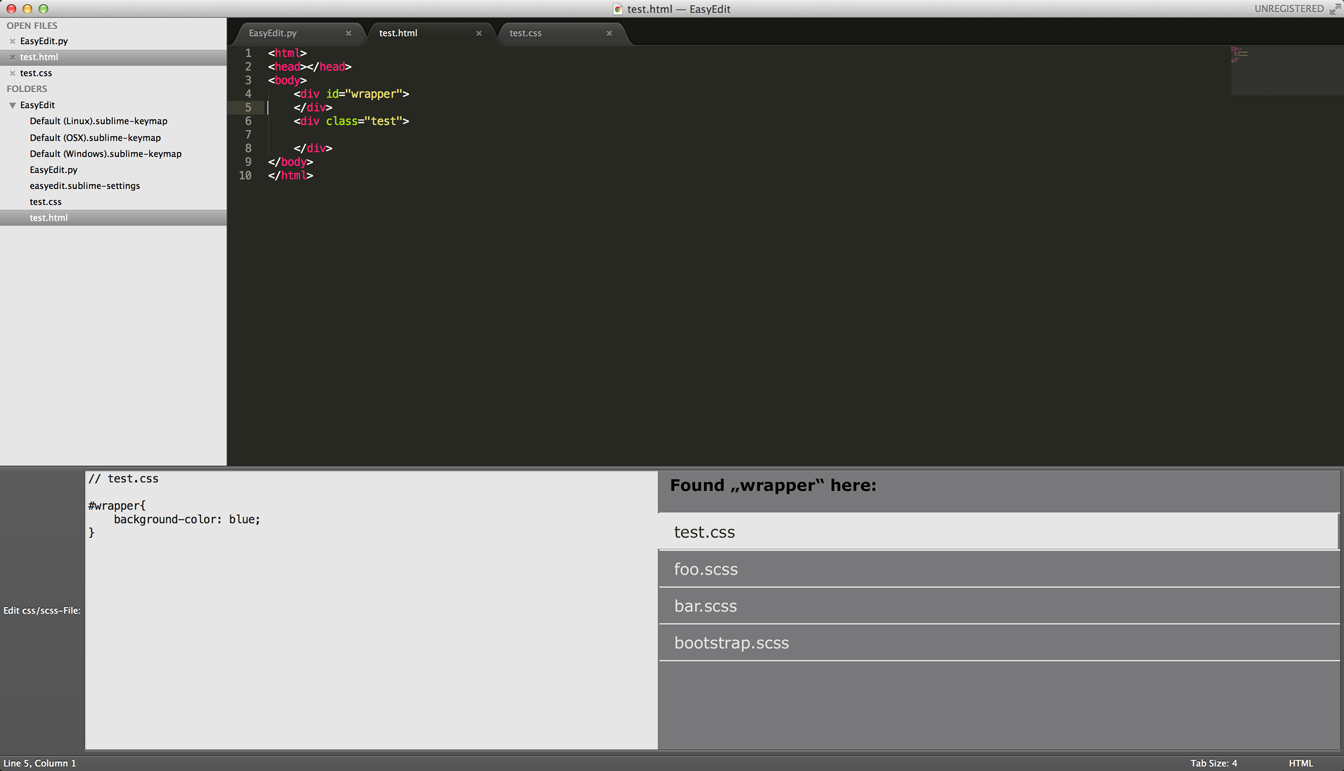

i´ve got one question. I would like to develop a plugin for sublime text.

It should be easy to edit .scss or .css code directly into the .html-file. Don´t switch to the .scss- or .css-files and look for the right line anymore. (screenshot).

Is there a possibility to customize the window.show_input_panel() ? I didn´t find anything about it...

Thanks for your answers

.

.Best regards,

Martin

MAGGHALI RESIDENCE - Crown Capital Bali

MAGGHALI RESIDENCE - Crown Capital Bali

Description : Magghali Residence consist of 4 stunning villa such as Magghali Uno, Magghali Duo, Magghali Tre and MagghaliGrande. Feel the comfort, ambience, and get relax in the other side of Sanur. This is the concept of residential that offers you much reason for living in Bali.

Location : Located in the prime villas area of sanur, Kutat Lestari. Only 30 minutes from Ngurah Rai Airport. From Villa D'Uma, it only takes 5 minutes to closest beach in sanur : Semawang.

Land size : Total 1900 m2, divided onto Magghali Uno : 302 m2, Magghali Duo : 320 m2, Magghali Tre : 320 m2 and Magghali Grande : 958 m2.

Built area: 289 m2 (Magghali Grande).

Offering price : Please send inquiry or call us for details.

Current progress : Concept and preliminary design for the Magghali Uno and Duo. Magghali Uno will be built on January 2013.

Many serious problems in 2181 build.

Many serious problems in 2181 build.

file too large,skipping

file too large,skipping

When i will search some words in the content, i get the tips what is "file too large,skipping". How can i do ?

Can we mark some code as temporary like bug echo like echo and print_r() or var_dump

Can we mark some code as temporary like bug echo like echo and print_r() or var_dump

Can we mark some code as temporary like bug echo like echo and print_r() or var_dump so that when we push changes then we use some hot key to remove all those marked changes to be removed and then code can be pushed without unwanted code...

Customer support service by UserEcho