0

Social Insurance Compliance in China, Insurance Compliance at Koyal Group

In this article, we

explore China’s social security system, which is especially complex because it

is organized at the regional level. While the formal social security system only

covers urban workers, some rural workers who move to the cities to work (the so-called “floating population”) are

also covered. On account of China’s sheer size and legal diversity, the

country’s social insurance system is among the

most difficult in the world to navigate.

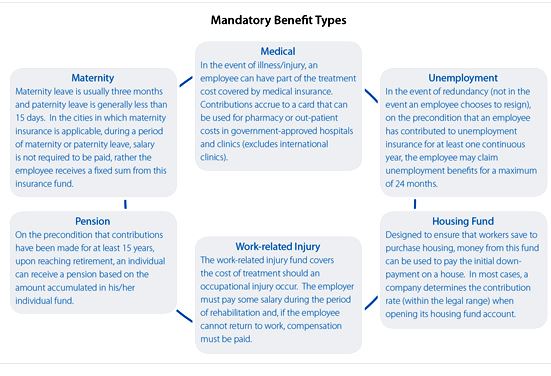

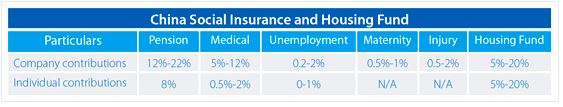

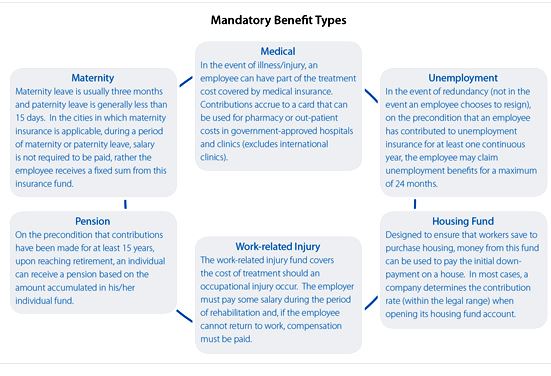

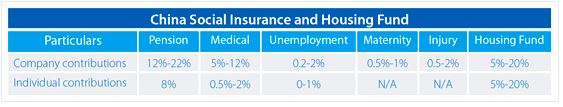

The social security system in China consists of five different types of insurance, plus one mandatory housing fund, introduced in the chart below. How companies register and deregister their employees often varies depending upon the city and the employee’s location or residency. In many large cities (with some notable exceptions such as Beijing), the registration and deregistration of most employees can be completed online. Similar to withholding tax, companies can make monthly contributions to the fund via direct debit. Many city governments, however, also restrict which banks are able to facilitate the transaction. At the present time, local Chinese banks can facilitate these transactions and businesses should verify which banks are approved by the local government to do so in their area of operation.

This article is an excerpt from the January and February 2014 issue of Asia Briefing Magazine, titled “Payroll Processing Across Asia.” In this issue of Asia Briefing Magazine, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use to manage their payroll across various countries with external vendors, and explain the differences among three main models: country-by-country, managed, and integrated models while highlighting some benefits and drawbacks of each.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

The social security system in China consists of five different types of insurance, plus one mandatory housing fund, introduced in the chart below. How companies register and deregister their employees often varies depending upon the city and the employee’s location or residency. In many large cities (with some notable exceptions such as Beijing), the registration and deregistration of most employees can be completed online. Similar to withholding tax, companies can make monthly contributions to the fund via direct debit. Many city governments, however, also restrict which banks are able to facilitate the transaction. At the present time, local Chinese banks can facilitate these transactions and businesses should verify which banks are approved by the local government to do so in their area of operation.

This article is an excerpt from the January and February 2014 issue of Asia Briefing Magazine, titled “Payroll Processing Across Asia.” In this issue of Asia Briefing Magazine, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use to manage their payroll across various countries with external vendors, and explain the differences among three main models: country-by-country, managed, and integrated models while highlighting some benefits and drawbacks of each.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Служба підтримки клієнтів працює на UserEcho