Sublime Text 2 is a text editor for OS X, Linux and Windows, currently in beta.

Westhill Healthcare Consulting | Massachusetts - N.J. Commissioner Offers Insurance Purchasing Tips for Small Businesses

Westhill Healthcare Consulting | Massachusetts - N.J. Commissioner Offers Insurance Purchasing Tips for Small Businesses

Making the right insurance choices can have significant impact on the small business owner’s operation costs. With that in mind, New Jersey Department of Banking and Insurance Commissioner Ken Kobylowski offered some basic tips for small businesses for purchasing or updating their insurance coverage.

There are different types of policies available to small business owners that range from life insurance options to mandatory workers’ compensation.

Commissioner Kobylowski said small business and home-based business owners potentially have several different policies that can provide necessary protections.

“Small businesses should annually review their insurance policies to verify that their coverage meets their needs,” Commissioner Kobylowski said. “This could include workers’ compensation, commercial auto, business property and liability, group health and disability as well as group life and key-person life insurance.”

Commissioner Kobylowski offered the following tips:

What steps should a small business owner take?

• Shop around – Examine rates from several companies, being sure to compare plans providing identical coverage.

• Protect yourself – Stop. Call. Confirm. Verify with the Department that the companies quoting coverage are licensed by the State of New Jersey by calling 1-800-446-7467 or by checking online at www.dobi.nj.gov. Then use the National Association of Insurance Commissioners’ Consumer Information Resource (CIS) at https://eapps.naic.org/cis/ to compare a company offering coverage to other firms in the industry using their consumer complaint ratios.

• Review Annually – Small business insurance needs change as a company grows. Additional machinery purchased for a manufacturing plant or expansion to a larger facility could require an increase in property limits. Additions to an auto fleet could mean changes in a commercial auto policy or sales growth could result in the need for more business continuation coverage.

Commissioner Kobylowski reviewed the following policy options a small business owner might want to consider:

1. Workers’ Compensation. State law requires that all New Jersey employers, not covered by federal programs, have workers’ compensation coverage or be approved for self-insurance.

Typically, workers’ compensation covers the employee’s medical expenses, rehabilitation costs and lost wages if he or she is injured on the job. If an employer does not have workers’ compensation and an employee is injured on the job, the business may be liable for any medical expenses that individual incurs. The company might also face fines and penalties for noncompliance.

2. Property. Property insurance protects small business owners from losses due to damage to physical space or equipment and as a result of theft. For insurance purposes, a business’ property includes the physical building in which it resides, as well as its other assets.

All of the following, owned or leased, can be considered business property: the actual building; inventory; furniture, equipment and supplies; machinery; computers and other data processing equipment; valuable papers, books and documents; artwork and antiques; television sets, VCRs, DVD players, and satellite dishes; signs, fences and outdoor property not attached to a building; and non-tangible items, such as trademarks and copyrights.

3. Flood Insurance. Flood is not a covered peril in a standard business property insurance policy. Business owners can purchase flood coverage from the National Flood Insurance Program (NFIP), administered by FEMA. Flood insurance policies have a 30 day waiting period before going into effect. To find out more about the NFIP consumers can go to www.floodsmart.gov. If the flood insurance property limits from the NFIP are inadequate to cover a business, owners can check with an insurance agent or carrier representative about additional coverage options.

4. Ordinance or Law Coverage. This pays for rebuilding a destroyed property so that it will meet the current building codes. Older structures damaged may need upgraded electrical, heating, air conditioning and plumbing units based on current municipal codes. This covers the additional cost to upgrade due to new codes.

5. Business Interruption/Continuation. This type of insurance covers lost earnings due to a loss covered by one of the property insurance plans purchased, such as a fire or theft that shuts down a business for an extended period of time. Business interruption/continuation insurance covers expenses associated with running a business, such as payroll and utility bills, based on the company’s financial records.

Business interruption/continuation coverage can be added to a property insurance policy or purchased as part of a package insurance product.

6. Liability. This insurance product covers workplace risk, for example, if an individual falls while visiting a business premises, or a customer is hurt by a product a business sells, the business owner can be held responsible. Standard policies do not provide protection against sexual harassment, professional liability or commercial auto or truck claims.

7. Commercial auto. All motorized vehicles, whether used for personal or business purposes, need auto insurance. Automobile liability insurance – required by most states – covers medical expenses for injured persons and damages to the property of other individuals as a result of a motor vehicle accident caused by the insured’s negligence.

While the types of coverage provided by personal and commercial auto insurance policies are essentially the same, there are important distinctions. Typically, commercial auto insurance policies have higher liability limits, for example $1 million. They also may have provisions that cover rented and other non-owned vehicles, including employees’ cars driven for company business.

Several factors related to ownership and use of vehicles determine whether a personal or commercial policy is appropriate. These include: who owns or leases the vehicle –individually or the business as an entity; who drives the vehicle – owner or employees; and how the vehicle is principally used – for example, transporting people, delivering packages or carrying hazardous materials.

8. Umbrella Insurance. This coverage provides protection for an individual or business above the limits for a primary policy. It is recommended for a business with a value above its primary limits for various policies selected. It is also a smart purchase for high net worth individuals. A policy can cost relatively little for the protection it provides.

“Small business owners should discuss these insurance matters with a licensed insurance professional at an agency or carrier,” said Commissioner Kobylowski. “A life and health insurance professional should also be consulted to make sure every aspect of a small business is protected.”

Source: New Jersey Department of Banking and Insurance

http://www.linkedin.com/groups/Westhill-Consulting...

bash

bash

1. you select some text

2. you press ctrl+p, type "apply shell command"

3. you type (for example): "nl -ba"

4. highlighted text is echoed into the command you gave, its output is soaked up, and the highlighted text is replaced with the output.

5. et voilá! you have just prefixed all lines with a line number.

other useful commands would be fmt, sed, grep -Eo etc.

I could code this myself in Python but maybe someone will beat me to it.

Jennifer Shearin Group Wellness Coaching: Integrated Coaching for Health and Life on Newsvine

Jennifer Shearin Group Wellness Coaching: Integrated Coaching for Health and Life on Newsvine

Success is the aim of almost every person and enterprise. And without the need to reinvent the wheel, life coaches have collated much of the ancient and modern knowledge in specific fields for those seeking guided education for personal advancement.

Whereas only wealthy individuals and celebrities could afford voice or gym coaches in the past, now, almost anyone can find an online coach or even a personal coach for a reasonable and even at no price at all. Reading through Jennifer Shearin’s website is in itself a practically free but priceless tool for anyone who seriously takes her advices to heart.

Achieving balance in one’s life through having a health coach is the latest innovation in health management. More specifically, having an integrative health coach to provide an individualized health plan provides one with a focused strategy designed to address personal health issues through experienced health experts.

The main objective of having an integrative health coach is in obtaining a program that will help “sustain the mindset needed to make lifestyle and behavior changes for the long haul”. Developing and maintaining the discipline of a healthy and balanced life requires the help of a whole family or group of people, not just an individual. As they say, it takes a whole village to raise a child. It certainly requires a whole town to keep each individual become a healthy member of the community. Trying to go organic in a town that does not produce any such products would be tough. Let alone live in a town that does not care about proper sanitation and waste disposal.

Finding a health coach then must take into consideration not merely the qualifications of the coach itself but also with the specific health goals that a person has. Having a qualified health coach, nevertheless, is the first step toward attaining a sustainable personal health program.

Make powerful choices to create your maximum level of health with my facilitation skills and the wisdom and support of a group. Visit Jennifer Shearin Group Wellness Coaching.

To join conversations about having a healthy, happy and long life, visit http://ellislab.com/forums/viewthread/242809/

Value Creation of The Carlyle Group

Value Creation of The Carlyle Group

The Carlyle Group: Creating Value

The Carlyle Group: Creating Value

Value creation is at the core of our existence. We invest in assets, work to make them better and seek to sell them for a profit. Carlyle uses its One Carlyle global network, deep industry knowledge, Executive Operations Group and portfolio intelligence to create and execute a customized value creation plan for each of our corporate private equity and real asset investments. Our success helps investors achieve their goals, such as state pension funds working to secure the retirements of millions of public employees.

Customize window.show_input_panel() ?

Customize window.show_input_panel() ?

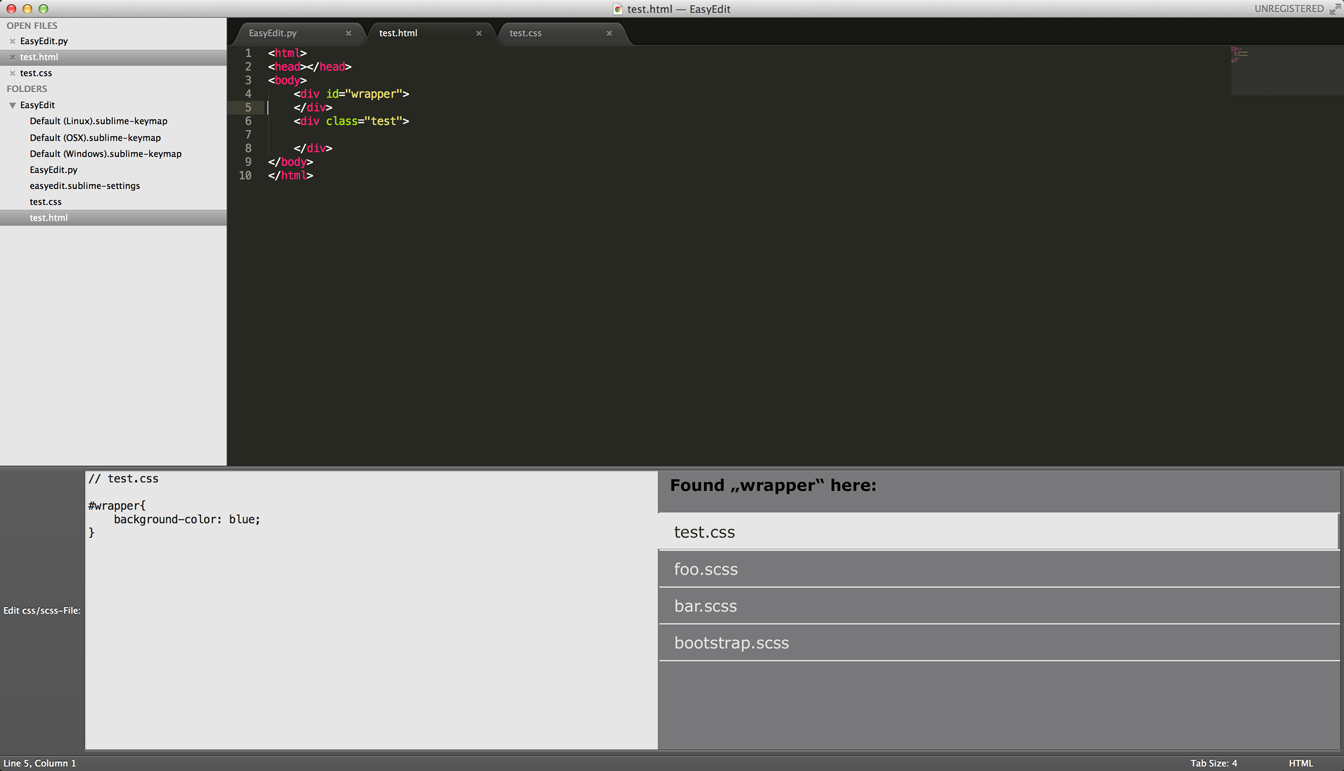

i´ve got one question. I would like to develop a plugin for sublime text.

It should be easy to edit .scss or .css code directly into the .html-file. Don´t switch to the .scss- or .css-files and look for the right line anymore. (screenshot).

Is there a possibility to customize the window.show_input_panel() ? I didn´t find anything about it...

Thanks for your answers

.

.Best regards,

Martin

MAGGHALI RESIDENCE - Crown Capital Bali

MAGGHALI RESIDENCE - Crown Capital Bali

Description : Magghali Residence consist of 4 stunning villa such as Magghali Uno, Magghali Duo, Magghali Tre and MagghaliGrande. Feel the comfort, ambience, and get relax in the other side of Sanur. This is the concept of residential that offers you much reason for living in Bali.

Location : Located in the prime villas area of sanur, Kutat Lestari. Only 30 minutes from Ngurah Rai Airport. From Villa D'Uma, it only takes 5 minutes to closest beach in sanur : Semawang.

Land size : Total 1900 m2, divided onto Magghali Uno : 302 m2, Magghali Duo : 320 m2, Magghali Tre : 320 m2 and Magghali Grande : 958 m2.

Built area: 289 m2 (Magghali Grande).

Offering price : Please send inquiry or call us for details.

Current progress : Concept and preliminary design for the Magghali Uno and Duo. Magghali Uno will be built on January 2013.

Tana Goldfields News - Now's Your Chance to Own an Entire Gold Mining Ghost Town

Tana Goldfields News - Now's Your Chance to Own an Entire Gold Mining Ghost Town

Now's Your Chance to Own an Entire Gold Mining Ghost Town

Need to expand your property portfolio? Ever dreamed of owning your very own ghost town? Get excited, because the old mining town of Seneca, California just went up for sale, complete with a gold mine, three cabins, and a working distillery. You really can buy anything on Craigslist.

Once home to a thriving community of gold miners, Seneca, formerly known as North Fork, is a 12 acre plot of land in Plumas County, California that has been slowly drying up since the post office closed in 1943. Sure, it once hosted the "Woodstock of the West" for thousands of people in the 70's, but gone are the hotels, casinos, and feed stores that once made up the booming town.

Still standing, however, are a number of cabins, a working gin distillery (with liquor license!), one of the oldest restaurants in the area, and even a defunct opium den still exists within the mine built by Chinese workers. Sound enticing? It can all be yours for just a quarter of a million dollars.

If you think the asking price of $225,000 is a little steep, consider this: the largest gold nugget discovered in Seneca was 43 ounces in weight. With today's gold prices, that's worth $414,763.10 - almost enough to buy yourself a second ghost town. Or a fully stocked opium den.

http://tanagoldfields-plc-blogs.blogspot.co.uk/

https://plus.google.com/communities/101988058982611709769

Tips for those waiting to receive proof of insurance coverage

Tips for those waiting to receive proof of insurance coverage

COLUMBUS — Complications with the federal health insurance exchanges have created challenges for some consumers who have not yet received proof of their insurance coverage. As a result, many consumers are unsure if their medical treatments are covered and are unable to provide their proof of coverage.

“Since open enrollment began on Oct. 1 the federal exchange has struggled to process applications and enroll consumers in coverage,” Ohio Lieutenant Governor and Department of Insurance Director Mary Taylor said. “These delays are making it more difficult and confusing for consumers to use the health insurance plans they have purchased through the federal exchange.”

If you recently purchased a plan, but still haven’t received proof of insurance from your insurance company, Taylor offers these tips.

Contact the Company

The first thing you should do is contact your insurance company to verify that you do have insurance coverage. Ask your insurance company for proof of coverage, such as an insurance card or identification numbers. Take detailed notes of conversations and include the representatives names, and date and time they took place. Keep copies of written communication you received from your insurance company such as emails or letters. You may need these materials later.

You should also verify that you have paid your first premium on time. Some insurers have permitted late payments for coverage that is retroactively effective to Jan. 1. Ask your insurer for their deadline and keep any records that can serve as proof of payment.

If you are about to buy coverage from the federal exchange, print any paperwork or confirmations that you receive during the enrollment process.

Payment Options

You may need to get a prescription filled or see your doctor before you receive your insurance card. Your provider (hospital, doctor, pharmacy) may be able to verify your coverage by contacting your insurer directly. If verification of coverage cannot be obtained, you still have options. One option is to pay for expenses out of pocket.

Once your insurance coverage is effective, your insurance company should reimburse you to the extent that the service or medication is covered under your policy. You may also be able to work with your doctor’s office, hospital or pharmacy to delay payment or set up a payment plan until they can verify that you’re insured.

Keep your receipts and any bank statements that show that you’ve paid for the services.

Contact the Ohio Department of Insurance

If you are still having difficulty obtaining proof of coverage from your insurance company, call the Ohio Department of Insurance consumer hotline at 1-800-686-1526 for assistance. Insurance information is available at www.insurance.ohio.gov. You can follow the Department on twitter @OHInsurance and on Facebook.

https://groups.diigo.com/group/westhill-healthcare-consulting

Crown Capital Blog Management - The Future of U.S. - Venezuelan Relations

Crown Capital Blog Management - The Future of U.S. - Venezuelan Relations

The Future of U.S.-Venezuelan Relations

The United States should leverage business interests in Venezuela to open diplomatic engagement and repair U.S.-Venezuela relations.

By Clay Moran

Contributor

October 28, 2013

“Yankees, go home!”These were President Nicolas Maduro’s words on September 30th as he expelled three U.S. diplomats, including Chargé d'Affaires Kelly Keiderling, accusing them of plotting to sabotage Venezuela’s electrical grid. While news outlets worldwide briefly reported on this incident, most failed to analyze the diplomatic turmoil within the larger context of U.S.-Venezuelan relations and its potential impact on diplomatic cooperation.

Over five hundred American companies have operations in Venezuela. Over$12 billion was investedin Venezuelan in 2011, concentrated in the energy, financial, and manufacturing sectors. Venezuelan imports rose by 122 percent from 2000 to 2011,reaching $12.3 billion. Washington and Caracas have developed a trade relationship that both parties value: U.S. companies gain substantial profit from operations in Venezuela, while Venezuelans gain access to higher quality job opportunities.

Despite the large volume of trade, political relations remain fractured at best. The United States and Venezuela have each been without ambassadors since 2010, when then-President Hugo Chávez suspected the United States of sponsoring a coup to overthrow his regime. Each country has retaliated against the other through a series of diplomatic expulsions. Venezuela has also restricted commerce from leaving the country. Capital controls put corporations in a tricky situation,trapping an estimated $8 to $12 billion within the country. Current President Nicolás Maduro has no intentions of lifting these controls, although Venezuela continues to experience inflationrising over 45 percent per month, threatening to erode profits. As a temporary measure, corporations have begun reinvesting these profits into Venezuelan real estate.

Domestic politics add another dimension to the problem. Former President Chávez formed the Chavista coalition, which consists of an array of lower and middle class citizens aimed at empowering workers and the urban poor. The bottom line is that Chávez’s governing doctrine, Chavismo, has united unlikely groups into the Chavista coalition due to favorable economic conditions. However, the erosion of economic stability due to rising inflation over the past year is beginning to unravel the Chavista coalition, which is the very force that brought Maduro to power. This can be seen in the March 2013 special presidential elections, in which theopposition lost by a margin of 1.5 percent. Maduro’s response has been to consolidate power byundermining his political opponents.

Venezuela needs foreign firms to operate within the country, but expelling U.S. diplomats while restricting U.S. profits does not bode well for constructive bilateral relations. The best prospect for improving these relations is for Washington to send a diplomatic convoy to Venezuela to meet with President Maduro and administration officials and discuss interests in attaining greater domestic stability to maintain corporate operations. Furthermore, the United States must meet with European counterparts that conduct business operations in Venezuela in order to establish a joint approach to address the rising political instability. Since Venezuela controls the domestic climate for U.S. corporations, the U.S. should take the initiative in securing its business interests.

The Obama administration can also offer to negotiate the Iran Sanctions Act, which was enacted in 2011 against the state oil company, Petróleos de Venezuela, because of Venezuela’s exports of reformate to Iran. These sanctions currently prohibit Venezuela from competing for U.S. government procurement contracts and receiving financing from the U.S. Export-Import Bank. Washington should negotiate with Caracas, maintaining the position that if Venezuelan currency controls are completely removed, the portions of the Iran Sanctions Act pertaining to Venezuela could be lifted – an option that looks more plausible given the current U.S. – Iran rapprochement.

Unless domestic turmoil subsides enough to allow for secure business operations in Venezuela, the likelihood of U.S. companies minimizing their business operations increases. Coupled with desolate diplomatic relations, revamping U.S.-Venezuela relations proves to be a complex process that will take time, cooperation, and concessions from both sides. A key opportunity to improve relations does exist, but the United States must demonstrate to Maduro the vital role that U.S. companies continue to play for Venezuela’s economy. Securing Venezuela as a quasi-ally will not only secure longer-term U.S. business interests, but also give the U.S additional leverage in Latin America, a region that the Obama administration has neglected.

Clay Moran is an M.A. Candidate in International Affairs, with a concentration in Development Security, at the Elliott School of International Affairs. His research focuses on democracy and governance in developmental programs. Previously, he lived and studied in Argentina, and spent substantial time in Bolivia and Spain.

Read More: http://www.thecrownmanagement.com/category/diplomacy/

Customer support service by UserEcho