On ubuntu 11.10 sublime text 2 2153 not work.

On ubuntu 11.10 sublime text 2 2153 not work.

{ "command": "move", "args": {"by": "words_ends", "forward": false} } doesn't do anything

{ "command": "move", "args": {"by": "words_ends", "forward": false} } doesn't do anything

Haskell "module" keyword versus identifier with same prefix

Haskell "module" keyword versus identifier with same prefix

The word "module" is a Haskell keyword, however, creating an identifier with a prefix of "module" is also valid. e.g.

modulez = "hi" -- valid Haskell

Unfortunately, this causes the editor to think I have used the module keyword, which screws up highlighting.

Gold Starts New Week On Upbeat Note

Gold Starts New Week On Upbeat Note

Investing.com - Coming off the best weekly performance in a month last week, gold futures again traded higher in the early part of Monday’s Asian as traders continued to boost the yellow metal higher.

On the Comex division of the New York Mercantile Exchange, gold futures for September delivery rose 0.43% to USD1,377.10 per troy ounce in Asian trading Monday. The September contract settled up 0.74% at USD1,371.20 per ounce last Friday.

Gold prices added 4.55% on the week, the strongest gain since the week ending July 12. The precious metal has rebounded 16% since hitting a 34-month low of USD1,180.15 a troy ounce on June 28.

Gold futures were likely to find support at USD1,304.50 a troy ounce, the low from August 9 and near-term resistance at USD1,391.35, the high from June 17.

Gold was embraced as a safe-haven play last week amid some concerning U.S. data points that weighed on stocks. In U.S. economic news out last Friday, the Thomson Reuters/University of Michigan's preliminary reading on the overall index on consumer sentiment for August fell to 80 from 85.1 in July. The August reading was the worst in four months.

The Commerce Department said housing starts rose 5.9% to 896,000 units. Economists expected housing starts to rise to 900,000 units.

Data indicate traders are boosting their long bets on bullion. According to the U.S. Commodities Futures Trading Commission, net long positions in gold futures and options contracts jumped 18% to 56,604 contracts for the week ending August 13.

Demand in India and possible mine strikes in South Africa may boost prices in the next four to five weeks before an industry conference in Denver, Bloomberg reported, citing a JPMorgan research report published last week.

Elsewhere, Comex silver for September delivery inched down 0.06% to USD23.307 per ounce while copper for September delivery rose 0.30% to USD3.372 per ounce.

RELATED ISSUE:

http://www.bookrix.com/search;keywords:%20%20tana%20goldfields,searchoption:books.html

Jump to test

Jump to test

Better visual cue when in multi-insert mode

Better visual cue when in multi-insert mode

On Selecting Multiple Lines

On Selecting Multiple Lines

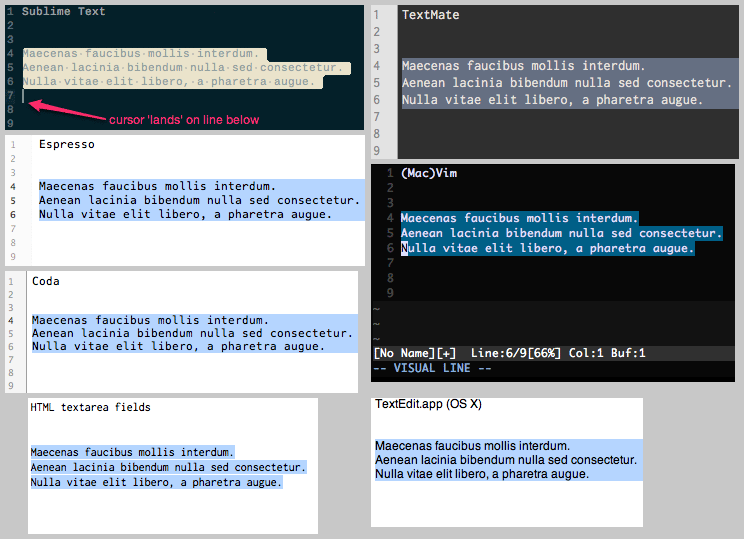

I have a small quibble with the way you select multiple lines of text in Sublime – or technically, how you see/perceive what's been selected when doing so.

Let's say you have these example lines below (throw in a couple empty lines above and below) …

Maecenas faucibus mollis interdum.

Aenean lacinia bibendum nulla sed consectetur.

Nulla vitae elit libero, a pharetra augue.

… To reproduce the behavior I'm referring to, please follow these steps:

1. Place the cursor on the beginning of the first line, right before the 'M' (in "Maecenas").

2. Press and hold Shift, then press Arrow Down 3 times.

The cursor lands on the line below the selected lines.

Compare with e.g. Vim's Visual Line selection (pressing capital V in normal mode). I'm hoping for Sublime Text to have the same behavior as when selecting Visual Line in Vim – which is also default in the vast majority of editors and places where you can edit and select text, i.e:

Highlighting only the lines you've selected and momentarily not showing the cursor.

So, my questions are:

- What is the motivation to employ this behavior of selecting multiple lines of text in Sublime?

- Is there a way to switch the behavior into the one that I (personally) am more used to?

I'm posting a reference image that shows the behavior in a few editing environments:

Sidenote: also, in Sublime Text, when selecting in the opposite direction (Shift-Arrow Up) it doesn't leave the cursor alone on the line above the selection. I think this holds some ground for my proposal to adapt Sublime to a more consistent behavior.

Reason for my personal preference towards the more common behavior is, well, because I'm more used to it (from editors like TextMate). In Sublime, it feels slightly more confusing when selecting, copying and pasting multiple lines of code. I believe I *can* get used it, though, and this is not a be-all and end-all issue, but it would be nice if it was possible to accommodate for people like me, who prefer the standard way, if I may call it such.

Regardless of what, in a broad perspective, I'm of course immensely pleased with Sublime Text!

vertically lock current line

vertically lock current line

I would really appreciate an option to lock the current line to a vertical position such that there are a constant number of lines before and after. Scrolling would not move the current line.

'Add line before' adds extra indentation level

'Add line before' adds extra indentation level

Remote Diff

Remote Diff

I've seen feature requests for diff functionality and for ftp integration but it would be really great to combine these two components so that remote diffs are possible like with PHPStorm. This way I can diff my local copy with the deployed version and make sure that I'm not making any unwanted changes.

The Elm Street Group at Morgan Stanley: Financial Planning

The Elm Street Group at Morgan Stanley: Financial Planning

- How Much Life Insurance Do You Need?

- Retirement Standard: Your Retirement Income Plan

- Retirement Standard: Risk Review

- Retirement Standard: Social Security Benefits

** More At: BagTheWeb - The Elm Street Group

This information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link: http://www.morganstanley.com/disclaimers/mssbemail.html. Any profiles and associated content are for U.S. residents only

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Morgan Stanley Smith Barney LLC and its affiliates do not provide tax or legal advice. To the extent that this material or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Any such taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor.

The securities/instruments, investments and investment strategies discussed in this material may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website do not necessarily reflect those of Morgan Stanley.

Change widget orientation

Change widget orientation

It would be great if you could customize the widget's orientation to be on the left or right of the window (vertical column instead of on the bottom in a row layout).

Viper mode: Delete inside <> and {} doesn't work

Viper mode: Delete inside <> and {} doesn't work

d i ( when inside (dgsddgs) works.

d i < when cursor is inside <> ( e.g. <fgsdfgf>) and di } when inside {} doesn't work.

It should work like vim. (applies to both ST2 and ST3)

VFS -- virtual FS API

VFS -- virtual FS API

Considering there really no big "killer" features in ST3, I'd like to propose one, which might me a big extension to ST.

Virtual File Systems API should implement file I/O based on plugins. The end developer API could be taken from existing projects, e.g. FUSE.

Rationale

VFS would allow deep integration with different off-site (not local) file editing without sacrificing any time for I/O waits. While there are lots of file system wrappers (e.g. FUSE), the implementation inside ST would benefit from higher integration with text edition and navigation tasks.

There is also a number of companies which use ST in corporate environments with high security requirements (e.g. no source code should be saved to local storage). VFS capability would allow to use ST in such environments.

End users would benefit from plugins for FTP, SFTP integration with file browser.

Virtual representations would also be possible. Consider a VFS based on class hierarchy with method definitions as leaves.

All this requires minor modifications to UI, but deep modifications to I/O core.

Fadeout horizontal overflow

Fadeout horizontal overflow

Regex find to use groups e.g. textBefore(.+)textAfter

Regex find to use groups e.g. textBefore(.+)textAfter

Reges find does not using groups. It just ignores () in search token.

Both Sublime 2 and 3. It would be nice if parenthesis are used, find would select/replace only terms in search groups, and FindAll would select only text in founded groups

python build results line jumping needs extra match group

python build results line jumping needs extra match group

Change

"file_regex": "^[ ]*File \"(...*?)\", line ([0-9]*)",

to

"file_regex": "^[ ]*File \"(...*?)\", line ([0-9]*)([0-9]*)",

And file:line jumps work.

Automatic * when we press enter for comments

Automatic * when we press enter for comments

/**

*

*/

Automatic * in new line when we press enter for comments inside /** and */

Customer support service by UserEcho